Hello Defiers! Here’s what’s happening in decentralized finance,

The latest crazy DeFi project is called Pickle Finance, and it actually might be providing value beyond lining farmers’ pockets

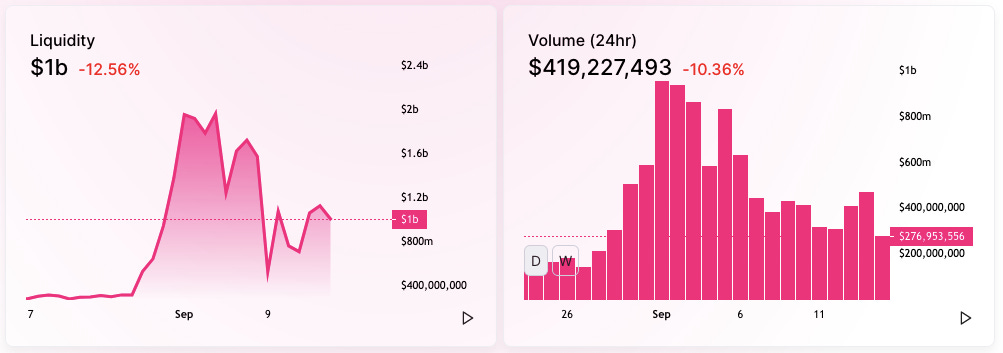

SushiSwap’s numbers are slumping across the board as Uniswap recovers its place as the top DEX

DeFi Pulse and Set Protocol team up to offer a “more Chad” DeFi index

[ UPDATED to include most recent weighs for sDEFI tokens]

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for 70 Dai/yr vs $100/yr).

Listen to this week’s podcast episode with musician RAC here:

Watch New Video on The Defiant’s YouTube Channel and Subscribe

Check out the just-released video on The Defiant’s YouTube channel! The amazing story of SushiSwap. The video was produced in partnership with Robin Schmidt of Harmony Protocol.

Together with Zerion, a simple interface to access and use decentralized finance, Perpetual Protocol, which provides decentralized perpetual contracts for any asset, and HackAtom V, a two-week virtual hackathon organized by Cosmos.

Stablecoin Volatility Got You in a Pickle?

Just when farmers thought food coins had run their course, perhaps the most absurd project yet is leveraging pickle memes to help mitigate stablecoin volatility.

Pickle Finance, a project incentivizing liquidity on the four largest DeFi stablecoins, saw $53M in 24 hour volume this weekend as its native governance token, PICKLE, traded as high as $85, according to CoinGecko.

Touting the tagline ‘Off-peg bad. On-peg good’, Pickle Finance offers more rewards to below-peg stablecoin pools and fewer rewards to above-peg stablecoin pools. As illustrated in the Pickle PicoPaper, the aim is to get people to sell above-peg stablecoins and buy below-peg stablecoins.

“Too many farming projects don’t actually do anything for the community,” the project’s whitepaper reads. “Pickle is an experiment that actually gives a shit.”

Pickle’s token liquidity pools are boasting what have become the typical returns for DeFi; 4,000% annualized yields for ‘Pool 2’ PICKLE/ETH LPs, for example.

Pickle Governance

As is all but required for new DeFi projects, PICKLE token holders can vote in a governance process. Pickle is innovating in this area by using quadratic voting — which takes the square root of each vote instead of counting it nominally— to prevent whales from having too much influence. The project’s governance structure prompted a response from Vitalik Buterin himself.

vitalik.eth @VitalikButerin

vitalik.eth @VitalikButerinSeptember 13th 2020

23 Retweets108 LikesDai Proposal

Two days after its hyped-up launch, and seeing that DAI was trading significantly above $1, Pickle governance voted to shift incentives to try to bring MakerDAO’s stablecoin closer to its peg. It’s unclear whether it was Pickle or something else, but Dai is now trading at $1.02, from as high as $1.05 yesterday, according to CoinGecko.

Stablecoin Arb

But, Pickle’s ambitions don’t stop there. In the coming weeks, Pickle Finance will seek to deploy pVaults, a way to stake PICKLE and earn profits from flash loan arbitrage opportunities on stablecoins trading off their peg.

Backed by a unique quadratic voting implementation, thousand-percent yields, and top-tier memes, it’s no wonder farmers are flocking to the latest absurdity. In a world of foodsanity, projects like Pickle are somehow finding ways to add ‘value’ to a sleepless DeFi sector.

SushiSwap Slumps as Uniswap Rides Into the Sunset

SushiSwap’s token is plunging along with the project’s liquidity and volume after SUSHI rewards were slashed. Not even a token buyback could spur a rebound.

SushiSwap was able to successfully migrate around $800M of Uniswap’s liquidity, but the slump that has followed across most of its metrics is proving that it’s harder than it initially seemed for a copycat protocol to beat the original.

SUSHI token is down 24% today to $1.87 amid a green crypto market, even after the project spent $14M of its treasury’s funds — the entire amount that founder Chef Nomi returned— to buy back the token yesterday.

SushiChef @SushiSwap

SushiChef @SushiSwapSushiChef@SushiSwap

Buyback starting now! https://t.co/qCqvZ2wNGvSeptember 15th 2020

51 Retweets184 LikesThe token had traded as high as $10 four days after SushiSwap was announced, and then it started to slide. The drop accelerated after founder Chef Nomi sold all his SUSHI, and while it bounced back after the anonymous developer returned his stash, it has yet to fully recover.

Assets Slide Below Uniswap’s

Value locked in SushiSwap, which briefly became the largest DEX by assets, is also sliding after the fork of Uniswap reduced tokens rewards from 1,000 SUSHI per block for liquidity providers, to 100 three days ago, as planned.

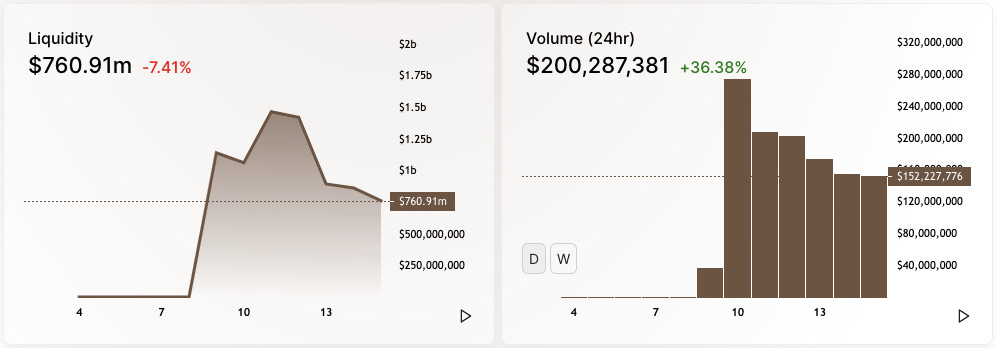

SushiSwap’s assets have dropped to $760M from as high as $1.1B on Sept. 9, when it performed its “vampire attack” and migrated tokens from Uniswap. Assets had climbed to as high as $1.46B on Sept 11, the day before rewards were slashed.

Image source: sushiswap.vision

That compares with $1B deposited in Uniswap’s liquidity pools, which makes the tokenless DEX the biggest by assets once more. Uniswap is also beating the upstart in daily trading volume, with $276M traded so far today, versus $152M on SushiSwap.

Image source: uniswap.info

The SushiSwap saga is proving that traders will flock to where the yield is, but once rewards taper out, they’ll just as quickly move on.

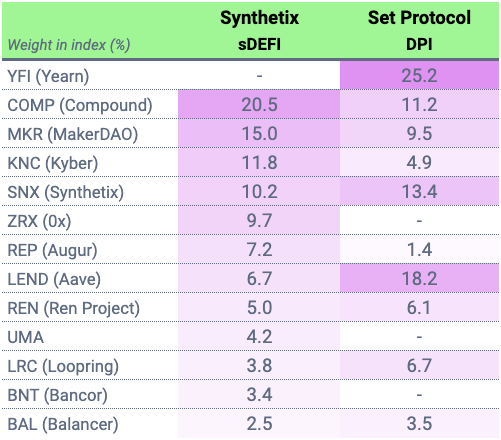

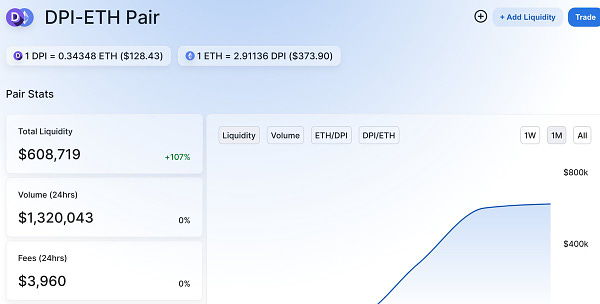

DeFi Pulse & Set Protocol Partner to Launch DeFi Index

DeFi Pulse – the creator of the widely-followed TVL leaderboard – is teaming up with Set Protocol, which provides access to non-custodial and automated crypto strategies, to launch an index tracking major DeFi tokens, called the DeFi Pulse Index.

The index is aimed at providing a one-click, single-asset vehicle for investors to gain exposure to the booming DeFi sector, that’s easier to access than other DeFi token baskets.

DPI Set attracted $700K of assets in the first 24hrs after its launch. It includes 10 of the top DeFi tokens, with weights which are not assigned by market cap, as in most index baskets, but rather according to a long list of requirements. It is comprised of the following assets and weights:

YFI – 25.22%

LEND – 18.16%

SNX – 13.40%

COMP – 11.18%

MKR – 9.48%

LRC – 6.65%

REN – 6.08%

BAL – 3.51

REP – 1.42%

Synthetix’s sDEFI

DPI Set is the first major index after Synthetix’s sDEFI Synth, giving users flexibility to choose from a number of passive baskets each containing different weighings.

sDEFI can only be accessed through the Synthetix Exchange using sUSD while the DeFi Pulse Index can be purchased directly through the TokenSet platform and Uniswap using ETH and top stablecoins like DAI and USDC.

Differences

The biggest difference between the two indexes is that in the case of sDEFI, the biggest weighted tokens are Compound’s COMP and MakerDAO’s MKR, with 20.5% and 15% respectively, while Set’s DPI gives 25% of its basket to Yearn Finance’s YFI.

sDEFI doesn’t include YFI yet, while DPI doesn’t include ZRX, UMA and BNT.

This Set is the first to use the platform’s new V2 smart contracts built to accommodate yield farming and aid in gas optimizations.

As the first major partnership between a DeFi data analytics firm and an asset management platform, it will be interesting to watch how platforms leverage their following to drive traffic towards web3 primitives like passive indexes.

Coinbase Pro adds YFI-USD trading, two months after the token launched.

Coinbase Pro @CoinbasePro

Coinbase Pro @CoinbaseProSeptember 15th 2020

18 Retweets68 LikesThe Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access at $10/month or $100/year, while free signups get only part of the content.

About the founder: I’m Camila Russo, author of The Infinite Machine, the first book on the history of Ethereum. I was previously at Bloomberg News in New York, Madrid and Buenos Aires covering markets. I’ve extensively covered crypto and finance, and now I’m diving into DeFi, the intersection of the two.